I’m Joining Microsoft!

Despite living in Seattle for almost all of my adult life, I haven’t actually worked for a local company in almost ten years. Remote work is great in so many ways, but in-person collaboration is what gives me life.

In confident pursuit of that feeling, I’m thrilled to be joining Microsoft to run Design & Research for their Web Experiences organization.

I was Microsoft-adjacent 10 years ago at MSNBC.com in Building 25, but this will be my first time as a blue badge, so to speak. I’m also thrilled to be joining Liz Danzico and John Maeda, who have also started at Microsoft in the last several months. I’ve known them both for a long time and have wanted to work with them forever.

There are several things which drew me to this opportunity, but at the top of the list is the people. Not just Liz and John, but the thousands of teammates in Seattle, Vancouver, Hyderabad, Barcelona, Beijing, and many other cities. There are certainly some great solo efforts in tech, but almost all of the best work I’ve been around has been the result of getting the right people jammin’ with each other. In my first several days here, I’ve already met so many of those people, and I can’t wait to continue the momentum Albert Shum created by carrying the torch for one of the best Design & Research teams in the Pacific Northwest.

The second thing I’m super excited about is the scale of the work. I’ve worked on the largest sports site in the world and one of the largest social networks in the world, but the properties in this group reach well over a billion people. Between the (refreshingly fast!) Edge browser, MSN, Bing, and several other products, Microsoft has quietly built up one of the top five properties in the world in terms of traffic and reach. They’ve also done it with humility, knowing how far they are from being perfect. I also love that so many of these products can and will be so much more as we begin to use some of the technology that’s emerging within Microsoft. In my first two weeks, I’m already overflowing with ideas.

Finally, the other thing I’m most excited about is getting back into the office in a flexible hybrid environment. I’ve worked in-person for most of my career and remotely for the last four years, and where I’ve landed is that everyone’s preferences are different, and it’s just tradeoffs all the way down. Where you land depends on a mix of your personality, your life outside of work, and what type of job you have. For me personally, I very much like being around people and feel like I do better work when I am… but I also like getting back my commute time a couple of days a week and making daily jogging more convenient. Also, Henry (pictured above) enjoys the extra lap time. Microsoft’s hybrid policy is a nice balance, and it sounds like exactly the right setup for someone like me.

Speaking of the exactly right, this also feels — for me at least — like exactly the right time to join Microsoft. The company has been through several distinct eras over the decades, but this feels like the era of re-commitment to the planet. To customers delightful experiences, to employees a great environment, and to the natural world, a smaller and eventually negative carbon footprint.

It’s a new year, and I couldn’t be any more here for it!

How to Automatically Post your Tweets to Mastodon

Over the last several weeks, I’ve gotten in the habit of trying to move all of my Twitter activity over to Mastodon instead. I signed up for Mastodon several years ago, but only now are there enough people using it for it to replace a lot of what you might use Twitter for. Some of your friends are there, some of your favorite bots are there, and some news sources are there. What more do you need in life, really?

I’ve been using Pinafore (along with a user stylesheet I created… feel free to grab it for yourself) to use Mastodon on the web, and a combination of Ivory and Metatext on my iPhone. Ivory looks a bit nicer but Metatext has a Notifications tab that acts more you’re used to it working on Twitter.

If you want to move all of your activity over wholesale, go to town. If, however, you want to keep publishing Tweets on Twitter and have them automatically publish to your Mastodon account as well, this short guide is for you. The entire process should take around five minutes. It’s mostly just clicking around on a couple of websites.

Important: If you do this, the goal should not be just replicate your Tweets and never visit or engage on Mastodon. The goal should be to help you build your Mastodon presence and save you from having to manually double-post. Ideally you quickly get to the point where Mastodon becomes your primary crib.

Step 1: Open a Mastodon account

If you’ve already done this, great. If you haven’t, head to any server you want — like mastodon.social, for instance — and set up your account. You can always switch your server (along with any followers you accrue) later, so don’t stress about the server you choose.

Performance is the Moat

There is no shortage of opinions about today’s news that Adobe will be acquiring Figma, so I’ll try not to repeat any of what’s already been said here. A lot of it boils down to designers and engineers being understandably concerned that the product they’ve grown to love and put at the center of their workflows over the past few years is now under the control of another company. Adobe-specific concerns aside, this unease would also exist if the acquirer was Microsoft, Oracle, Amazon, Atlassian or just about anyone else in big tech, save maybe Apple. The jokes would just be different.

As someone who competed against Figma for a couple of years, I want to talk briefly about what makes them so hard to catch, and why I think Adobe ultimately decided they would never beat them:

Performance.

Even though I have spent over 20 years in the design industry working directly on consumer products, I never fully appreciated the importance of performance until working in the design tools industry.

Most digital consumer products are used in short bursts over a long period of time. Think about the Amazon app on your phone. You open it maybe once a week, peck around for what you need, hit Buy Now, and you’re on your way. If there is a two-second lag between purchasing and getting your confirmation screen, you don’t even think twice about it. Even in the case of an outright error, you just shake your head, hit reload, and things are usually fixed.

With professional production tools though — whether design, engineering, or otherwise — full-time craftspeople spend almost every hour of every work-week inside of your software. Every time something goes even remotely astray, it is noticed. Putting aside catastrophic stuff like data loss, even things like cursor lag, screen flicker, progress bars, and scroll/zoom performance are tiny paper cuts that form into pools of blood by the end of each day.

Figma did a lot of things right over the ten (yes, ten!) years they’ve worked on the product, but one thing they did that no one else has been able to replicate is meet and in some cases exceed native app performance inside of a web browser.

Nothing Figma has accomplished in the marketplace would be possible without this, and it is the thing that competitors have struggled the hardest to replicate. When you build software using native code, you get a lot of stuff for free. Need a scrolling list? Apple, Microsoft, and Google have multiple pre-built components you can use. Need to draw one semi-transparent shape on top of another? The system already knows how to render that. Need to optimize it all for speed? Most of that work has already been done.

Inside of a browser though, the work is rarely done for you. Even in instances where someone has already built a component, it’s often too slow or glitchy to use in a professional development environment. So what did Figma do about this? Over the course of several years, they:

- Built their own components and architecture painstakingly from scratch and never settled for “good enough”

- Worked with organizations like WebKit and Chromium to improve web browsers themselves (the benefits of which go beyond Figma)

- Detailed out in the open what they were doing and how

It was this last one that really made me see how wide the moat was for the first time. Normally companies keep their secret sauce secret. After all, why would you want to give your competitors any information that might help them compete? But a company who routinely publishes information that is useful to competitors? That is some confident shit right there. It reminded me of a tweet I can’t find from several years ago:

“The design tool war is already over, but no one knows it yet.”

Fast forward a few years and everyone who has tried to match Figma’s all-around performance has fallen short. Private companies like Sketch and InVision. Public companies like Adobe. It’s not for lack of effort by hundreds of incredibly smart people. It’s just really frickin’ hard. Combine that with the fact that Figma is a moving target who is now building entirely new capabilities, and you can see why Adobe decided this wasn’t just a move they wanted to make… it was a move they had to make.

… which brings us back to a lot of the reaction we are seeing on Design Twitter today.

I don’t think people mind the abstract concept of Figma being acquired by another company nearly as much as they mind the very real threat of Figma losing what makes it so special in the first place: focusing maniacally on performance, thinking differently, and optimizing for user experience above all else. The backlash is an expression of how a lot of people feel Adobe has done in those categories over the last decade.

If I’m Adobe, I am printing out as many Tweets from today as I can, making a book out of them, and then doing this:

After that, I’m letting Figma lay the tracks for the next decade of this industry and rallying the thousands of talented people at my own company to rethink how the entire organization builds software. Within the next several years, it’s going to be possible to go from idea in the morning, to prototype in the afternoon, to working code in the evening… and the company who can do that most thoughtfully is going to be one of the most important companies in the world.

A Quarterback-Only Strike: How NFL Players Can Win This Labor Deal

I have never been less qualified to write about anything than I am about NFL labor negotiations, but I had a crazy idea a little while ago for how NFL players can win their labor dispute with owners and I want to get it out there for battle-testing.

Players put their bodies on the line every day to a degree that most of them are not fairly compensated for, so I will almost always side with players in terms of wanting them to get the best deal possible. This is a unconventional idea to help achieve that goal and get both sides to a good and equitable place as quickly as possible.

The elevator pitch

Before the start of the 2020 NFL season, all 32 starting quarterbacks should initiate a quarterback-only strike. Everyone else shows up to work and gets paid. If there is no acceptable deal in place by opening week, the games begin, the quality of play degrades dramatically, ratings/attendance/sales tank, and owners — unable to wait out a group of 32 players with many millions more in financial security than 99% of the league — are forced back to the bargaining table with a 16-game season, a true 50/50 revenue split, and a few other things players are quite reasonably asking for.

Why it will work

Athletes get out-negotiated by owners for a very simple reason: there are 32 owners and none of them ever need another paycheck again. Losing even vast amounts of their fortunes will not degrade their quality of life. There are 1696 active NFL players and most of them are materially affected every time they miss even a single game check. 32 billionaires vs over a thousand normal people who need paychecks is a recipe for exactly the sort of terrible deal that was signed ten years ago and threatens to be signed again. The goal of a Quarterback-Only Strike is to change the equation to 32 billionaires vs 32 of the most popular cash-rich players.

Do quarterbacks really have that much cash cushion? Let’s take a look at lifetime earnings for the 32 starting quarterbacks in the league right now. Note that this doesn’t even include endorsements, but also doesn’t include taxes:

- Drew Brees: $244m

- Tom Brady: $235m

- Rodgers: $233m

- Roethlisberger: $232m

- Ryan: $223m

- Rivers: $218

- Stafford: $210m

- Newton: $121m

- Wilson: $109m

- Cousins: $100m

- Dalton: $83m

- Tannehill: $77m

- Carr: $72m

- Garoppolo: $64m

- Fitzpatrick: $63m

- Foles: $62m

- Goff: $49m

- Winston: $46m

- Wentz: $39m

- Trubisky: $24m

- Mayfield: $24m

- Murray: $24m

- Darnold: $22m

- Brissett: $17m

- Jones: $17m

- Allen: $15m

- Mahomes: $13m

- Watson: $11m

- Haskins: $9m

- Jackson: $6m

- Prescott: $5m

- Lock: $4m

I have no idea how these guys invest or spend their money, but in my estimation, until you get down to the final few players (especially Dak… sorry Dak!), you are looking at pretty good financial cushions. Certainly enough to weather a few games or an entire season… especially if you include lost backpay in your deal requirements. Most position players in the league cannot afford this sort of holdout, but pretty much all starting QBs can.

It’s also possible that other players who have lifetime earnings over, say $25m, decide to join this strike in solidarity, but it’s not strictly necessary. Some marquee names might include J.J. Watt ($85m), Richard Sherman ($69m), or the NFL’s top selling non-QB jersey title holder Odell Beckham Jr. ($48m).

The other thing that’s nice about this proposal is that it’s literally the only position in any sport that could pull it off. Football could easily weather a strike at any other position, but not quarterback. Baseball could weather a strike from any position — even pitchers. Fans love offense! Basketball could weather a strike from any position because superstars are spread out amongst all five positions. I don’t watch a lot of hockey or soccer so I will just assume they fit my narrative too. ¯\_(ツ)_/¯

Quarterbacks are almost always the face of the franchise, the entire game runs through them in today’s pass-heavy NFL, and this is the perfect time to consolidate that power against owners and use it to improve conditions for the other 1664 players who don’t hold the same cards they do.

When I initially came up with this cockamamie scheme a few months ago, the reason I thought it might not work is that of all players on an NFL team, you would think quarterbacks would be the coziest with owners. But now that I see my own team’s QB, Russell Wilson, along with Aaron Rodgers, come out as strongly against the current CBA proposal, I think this thing could have some legs.

In conclusion

If players cannot get the very best deal they deserve this offseason, a Quarterback-Only Strike should be actively considered because it changes the negotiation from 32 vs 1696 to 32 vs 32. Additionally, you only need a majority of owners to cave, so if a few owners are insulated by the fact that they don’t have star quarterbacks yet, the rest of the owners are still vulnerable.

It’s also entirely possible someone else has already thought of this and kicked enough holes in it to show why it wouldn’t work. Basically, I need some more eyes on this thing. Agents, players, sports attorneys, whoever. If you know of someone who you think would have an opinion about it, I’d love to hear from them. The comment section is open below.

A Year of Working Remotely

It’s been exactly one year since I joined InVision, and after learning the ropes of remote work at an 800+ person all-remote company, I wanted to share some thoughts on how placelessness may affect the way we work in the future.

First, let’s dispense with the easy part: despite what you may read on Twitter, remote work is neither the greatest thing in the world nor the worst. We are not moving to a world where offices go completely away, nor are we going through some sort of phase where remote work will eventually prove to be a giant waste of time. In other words, it’s complicated.

The way to look at remote work is that it’s a series of tradeoffs. You enjoy benefits in exchange for disadvantages. The uptake of remote work over the next decade will depend most on the minimization of those disadvantages rather than the maximization of the benefits. Reason being, the benefits are already substantial while many of the disadvantages will be lessened over time with technology and process improvements.

Instead of writing about the advantages and disadvantages separately, I’m going to cover several aspects of remote work and discuss the tradeoffs involved with each.

Superhuman’s Superficial Privacy Fixes Do Not Prevent It From Spying on You

Last week was a good week for privacy. Or was it?

It took an article I almost didn’t publish and tens of thousands of people saying they were creeped out, but Superhuman admitted they were wrong and reduced the danger that their surveillance pixels introduce. Good on Rahul Vohra and team for that.

I will say, however, that I’m a little surprised how quickly some people are rolling over and giving Superhuman credit for fixing a problem that they didn’t actually fix. From tech press articles implying that the company quickly closed all of its privacy issues, to friends sending me nice notes, I don’t think people are paying close enough attention here. This is not “Mission Accomplished” for ethical product design or privacy — at all.

I noticed two people — Walt Mossberg and Josh Constine — who spoke out immediately with the exact thoughts I had in my head.

1/ This is a good *first* step. Better than doing nothing. But it’s not enough. I read the full blog post. It makes no mention of disabling tracking how *often* the recipient opens the email. It’s also full of the rationalization that secret tracking is ok in “business” software. https://t.co/c0PbCRLgdp

— Walt Mossberg (@waltmossberg) July 3, 2019

I appreciate Superhuman’s changes, but the problem is recipients don’t know they’re tracked, and it’s still not going to warn them https://t.co/GPfUYVkBMs

— Josh Constine (@JoshConstine) July 3, 2019

Let’s take a look at how Superhuman explains their changes. Rahul correctly lays out four of the criticisms leveled at Superhuman’s read receipts:

Superhuman is Spying on You

Over the past 25 years, email has weaved itself into the daily fabric of life. Our inboxes contain everything from very personal letters, to work correspondence, to unsolicited inbound sales pitches. In many ways, they are an extension of our homes: private places where we are free to deal with what life throws at us in whatever way we see fit. Have an inbox zero policy? That’s up to you. Let your inbox build into the thousands and only deal with what you can stay on top of? That’s your business too.

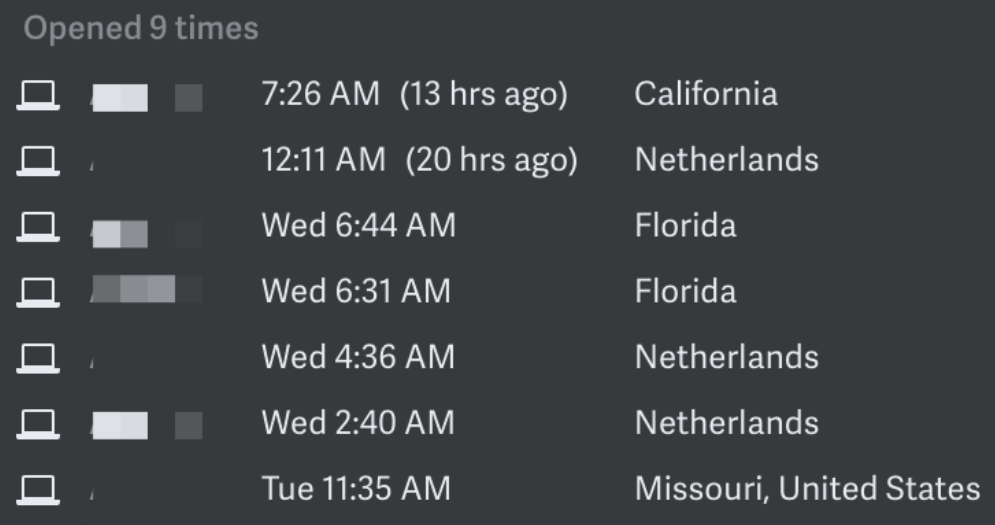

It is disappointing then that one of the most hyped new email clients, Superhuman, has decided to embed hidden tracking pixels inside of the emails its customers send out. Superhuman calls this feature “Read Receipts” and turns it on by default for its customers, without the consent of its recipients. You’ve heard the term “Read Receipts” before, so you have most likely been conditioned to believe it’s a simple “Read/Unread” status that people can opt out of. With Superhuman, it is not. If I send you an email using Superhuman (no matter what email client you use), and you open it 9 times, this is what I see:

That’s right. A running log of every single time you have opened my email, including your location when you opened it. Before we continue, ask yourself if you expect this information to be collected on you and relayed back to your parent, your child, your spouse, your co-worker, a salesperson, an ex, a random stranger, or a stalker every time you read an email. Although some one-to-many email blasting software has used similar technologies to track open rates, the answer is no; most people don’t expect this. People reasonably expect that when — and especially where — they read their email is their own business.

When I initially tweeted about this last week, the tweet was faved by a wide variety of people, including current and former employees and CEOs of companies ranging from Facebook, to Apple, to Twitter:

It was also met critically by several Superhuman users, as well as some Superhuman investors (who never disclosed that they were investors, even in past, private conversations with me). I want to talk about this issue because I think it’s instructive to how we build products and companies with a sense of ethics and responsibility. I think what Superhuman is doing here demonstrates a lack of regard for both.

First, a few caveats:

Clocking Back In… at InVision!

As a designer, I owe my entire livelihood to tools.

Some people survive on talent, vision, persistence, or a host of other superpowers, but to make up for what I lack, I’ve always been a tool nerd.

Whether it was messing around with Print Shop on a Commodore 64 when I was 10, teaching myself Photoshop 3.0 in my teens, or learning HTML via “HoT MetaL” while most designers were only doing print work, aggressively learning the tools of the near future has been one of the only consistencies of my career.

For that, and other reasons I’ll explain below, I’m incredibly excited to announce that after a refreshing two-year sabbatical from work, I’m joining one of my favorite companies — InVision — to head up Partnerships & Community!

We are entering a golden age of product design tools right now, and I’ve seen first-hand what introducing great prototyping and collaboration software like InVision can do within a company. It breaks down barriers between different groups and gets everyone thinking about user experience. It demystifies what product design actually is. It replaces 50-slide presentations and exhaustive spec documents with quick-to-create working demos that everyone can hold in their hand. More showing, less telling.

As my friend at Google, Darren Delaye once told me, there’s no better way to communicate a product idea than pulling out your phone and saying “Hey, wanna see something cool?”

When Clark and I first started talking about working together a little while ago — and about this role in particular — I’ll admit I had some question marks. In particular:

1. InVision is a fully distributed company with no offices.

A lot of people probably view this as a positive, but the thing I miss most about my last job at Twitter is being around my team and all of the other great people there. I’m an extrovert, and even if I have to brave open-office plans and commute times, being around teammates has always been important to me. Video calls, in fact, have always felt like a burden because face-to-face is the default mode of communication at most companies.

I had a really tough time evaluating what working remotely would be like, but in talking to Clark, Stephen, Aarron, David, Hilary and others at the company, everyone says exactly the same thing: it sounds like it’s going to be awkward, but after a couple of months, you never want to work any other way again. It’s great to be able to spend the first few hours of your day working from your couch, then go on a run whenever the weather clears up, and then spend the rest of the day working from your patio or your local coffee shop… all without ever getting stuck in traffic! InVision even gives you a $100 coffee & tea credit every month to encourage you to explore new surroundings.

It seems that when everyone is remote, the working dynamic changes. You aren’t sitting in a room with 10 people and then figuring out a way to dial in your poor London teammate with a choppy internet connection. You aren’t keying off of all of the social cues in the conference room and losing nuance from your one teammate in India. When everyone’s in the same boat — even if it’s a metaphorical boat held together by thousands of miles of fiber — something apparently changes.

I am now looking forward to this social experiment in telepresence, even if it means I have to remove the Zuck Tape covering my laptop’s camera. I think InVision is correct that this will be the new normal for a lot of companies over the next decade, and if you are a designer who doesn’t want to (or can’t) live in San Francisco, this seems like good news for you too. Either way, I will report back in a few weeks to let you know how it’s going.

2. I’m used to working on consumer products, as opposed to products that help people make other products.

Whether at ESPN, Newsvine, NBC, or Twitter, most of my career has been spent building things that consumers use. In evaluating each of those opportunities, I’ve tried to ask myself “what kind of impact is this going to have on the world?” This opportunity is a bit different because InVision doesn’t really touch consumers directly, but rather, it touches the designers, engineers, PMs, researchers, writers and others responsible for making the products that touch consumers. In that sense, it’s hard to trace the social impact of your work because you aren’t even aware of all the products that are being built with it. Having used InVision regularly myself, however, I am confident of three things: it tends to raise the profile of design work inside of companies, it facilitates a more inclusive product development process, and it ultimately helps create better user experiences. All great things.

You may say to yourself “but I like another tool better!” That’s totally fine. Any of the options available today are light years better than what we did ten years ago when we emailed JPEGs back and forth. I happen to think InVision is the best set of tools out there for entire organizations to use (with more products and capabilities on the way), but a world in which designers have several great options to choose from is a world I want to live in. Competition breeds excellence, and there is a lot more work for all of us to do.

One last note on tools and their impact: even though it was over ten years ago now and it started as a fun little hack, sIFR is still one of the projects I’ve enjoyed working on the most. None of us ever made a penny on it, or even tried to, but watching that little tool help people beautify typography across the web was really fulfilling. Seeing the need for it slowly disappear with the advent of TypeKit and proper web fonts was just as satisfying. It’s great to work on things that inch the world forward and make other people’s work better, and I look forward to doing that again in whatever ways I can at InVision.

3. The output of my work will, for the most part, not be directly within the product.

The role I’m taking on at InVision is not within Product, Engineering, or Design, so I won’t actually be working on the products themselves (but you can be sure I’ll be in people’s grills with ideas and feedback! 🧐).

Instead, I’ll be doing the following:

- Working with hundreds of companies and design teams around the world listening to how they currently develop products, how they want to develop products, and how we might be able to help.

- Keeping an eye on interesting new products and teams in the design software space and working on acquisitions when it makes sense.

- Designing and executing product integrations that bring the functionality of InVision to other platforms, and vice versa. InVision is already integrated with the largest platforms that drive digital product success, including those from Slack, Atlassian, Dropbox, and Microsoft, but there are still a lot more nodes in the digital product ecosystem to connect. The goal is to make the workflow of product design as seamless as possible, no matter what assortment of platforms a team is using.

- Emceeing InVision’s Design Leadership Forum, which hosts private events for design leaders from around the world. Its goal is to advance the practice of design leadership by creating a community where leaders can learn from one another.

- Further building out InVision’s programs within the traditional and continuing education spaces.

- Working on inclusive ways to bring the design community together, both online and off.

It’s a different sort of role for me, but at the same time, I’ve actually been doing a decent amount of exactly this sort of thing during my time off.

In some ways, this seems like the perfect opportunity at the perfect company right now, and yet, in other ways, I’ve never done anything like it! One thing that feels palpable already, however, is that this is a company driven by producing great experiences — for its customers, its partners, and its employees — and for that reason, I already feel at home (also, I *am* at home).

I’m not sure what my hiring plan is just yet, but if I’ve ever worked with you in the past or if you see anything you like in the 71 positions posted here, feel free to reach out to me directly! If you’re interested in helping power the next decade of digital product development from the comfort of wherever you choose to work, now is a great time to be joining InVision.

Design-Driven Companies. Are We There Yet?

It’s fashionable these days for companies to proclaim their commitment to great design.

You may hear things like “Design is very important to us” or “Design has a seat at the table” or even “We’re a design-driven organization”. As a designer evaluating job opportunities, should you take statements like this at face value or might you be able to get a clearer picture by asking questions, reviewing a company’s products, and other investigative means?

Throughout my 20 years in design, I’ve worked in everything from design-hostile to design-driven environments, and I can tell you that succeeding (and being happy) within each requires a different mindset going in.

Before discussing strategies, let’s describe several types of organizations along the design spectrum so as to identify what they look like. Importantly, when I say things like “design-driven”, I don’t necessarily mean Design-ER driven. In other words, it doesn’t mean that designers call all the shots. It just means that great care goes into every detail of the user experience of a company’s products. That level of detail could come from engineers, researchers, execs, or any number of other people (and often does!), but it also tends to correlate with designers playing key roles at the company.

The Spectrum of Design Drivenness

Design Hostile

CRMster is a 20-person startup that develops Customer Relationship Management software. There are 10 salespeople, 8 engineers, 1 CEO, and one contract designer. Most product decisions are made by the CEO and one salesperson. The rest of the team just builds whatever they are told to build. If a designer or engineer brings up concerns about a product feature, they are told to just stick to the program and produce what the CEO asked for as quickly as possible.

Design Ignorant

GitBusy is a 5-person startup building a new way to sync files across computers. All five team members are back-end engineers and they have spent their first year building out core functionality. The product is a bear to use, but it’s starting to work reliably. They keep making minor usability improvements but they’ve never thought to hire someone full-time who specializes in user experience.

Design Agnostic

MegaloBank is a Fortune 100 financial institution that employs over 10,000 people. They employ plenty of designers and design-minded people around the company, but mainly as support for other teams. If you asked the CEO of the company what his or her designers did, the response would be something like “I think they make our logos and business cards.” Important product design work does get done at Design Agnostic companies, but the people who do it just aren’t looked at as core talent the same way as sales, engineering, or marketing might be. Their compensation unfortunately reflects this.

Design Interested

CellYou is a 20-year old wireless carrier, employing over 10,000 people. They are feeling the heat from their competitors and have just embarked on a high-profile effort to redesign their product line so it is much easier to use. They don’t have all the right people in place yet, they aren’t walking the walk in terms of a user-centered product development process, and they still pay their designers a lot less than PMs and engineers, but they are starting to talk about things in the right way and starting to recognize the value of design. It may take a few years, but they are moving in the right direction. A lot of companies who say they are Design Driven are actually in this category instead.

Design Driven

HyperBowl is a 500 person company that makes a versatile kitchen appliance which can cook hundreds of different foods. It started as one chef and one engineer, but even from the very beginning, there was a relentless focus on building product prototypes and iterating them rigorously based on how they performed with users. New products are developed only when they can perform important jobs for users. At HyperBowl, there are 10 full-time designers but everyone in the company considers user experience to be one of their most important job functions. Many decisions are made with data and research, but there’s room for subjectivity, taste, and long-term vision as well.

Those are the five archetypes you’ll generally run across in the market today.

The Challenges of Each

As a designer, you may immediately think to yourself “I only want to work for a Design Driven organization!” If your goal is to join an environment that immediately affords you the ability to practice great design, then this is a natural choice. Take Apple, for instance. Whether you are fresh out of school or a 20-year design veteran, as a new employee at Apple, you won’t need to spend any of your time convincing anyone of the value of design. You will be paid roughly on par with engineers, expected to help lead the product development process, and likely do some of the best work of your career. I have a bunch of friends who have worked at Apple, and one of them summed it up best: it’s like career rocket fuel. You may find the work/life balance unsustainable in the long term, but your time there will be unencumbered by any fights about the value of design.

A lot of companies (even some of the largest and most successful in the world) will tell you they are Design Driven, but they are actually one level away, in the Design Interested category. You should always maintain a healthy suspicion about this, in fact. Like our cellular carrier above, they are in the midst of a positive transformation, but they just aren’t there yet. What this means for you as a designer (or researcher, or front-end engineer) is that not that you won’t be respected to listened to, but rather that part of your job will be to move the company from its old way of doing things to a new way of doing things. This involves a lot more than just your technical skills. It involves the patience to work in suboptimal conditions and the willingness to help lead the process of becoming more Design Driven. Thankfully since the company is already Design Interested, the “what”, “when”, and “why” have already been taken care of for you, but the “who” and “how” are still open questions. You are part of the who that will help determine the how!

A large number of companies in the world fit into the next category: Design Agnostic. These companies have found a way to turn a profit without paying as much attention to user experience as they could or should. Sometimes when you find a market need that is strong enough, you can get away with selling a “merely adequate” solution. Other times, your business is specifically aimed at gathering the most profit for the least amount of work possible. Joining a company like this requires you to be cool with one of two things. Either you are content to produce “good enough” work in a system that doesn’t value you as core talent, or you are interested in taking on the much larger challenge of turning your company into more of a Design Driven organization. To be clear, thousands of designers have no problem with the former, and I have no problem with that career choice. In fact, sometimes it’s all that exists, depending on geography, experience, economy health and other factors. The latter, however, is one of the hardest and most substantial things you could ever accomplish in your career. Imagine being the person (or small group of people in this case) who got Google to care about design? If you find yourself thinking about joining one of the many Design Agnostic companies in the world today, don’t think of it necessarily as “settling”. Think of it as an opportunity to redesign the entire product development factory within. If you succeed, they’ll carry you around on a rickshaw.

The next category, Design Ignorant companies, are actually a bit easier to make an impact in than Design Agnostic companies. That is because Design Ignorant companies haven’t normalized the role of design yet. They simply haven’t experienced it yet. In fact, you may even be treated more as a hero upon your arrival at a Design Ignorant company than a Design Driven company. Going back to our example above with the file-syncing startup, imagine how much immediate impact you’ll make when you optimize the sign-up flow, improve the product copy, and flatten the navigation. If you do your job well, you’ll be appreciated right from the start. Unfortunately, you probably won’t be paid well, but Design Driven companies are usually the only companies that pay designers what they are worth at this point. This is changing for the better, but it is a multi-year process.

Finally, at the end of the spectrum, are Design Hostile companies. Think of the challenges and rewards here much the same as Design Agnostic companies except these companies have already decided that your craft is but a necessary evil for them. This by far the least desirable company type for people in our field to work at, but hey, there are plenty of cases of these sorts of companies turning around eventually. In fact, I would venture to say that using my definitions here, there are plenty of Design Agnostic companies today that ten years ago may have been Design Hostile. If you find yourself entertaining an offer from a company like this, you really need to determine how pliable they are with regard to how they view design and whether you’re ok with that.

Strategies to Know What You’re Getting Into

There are four ways to determine what sort of company you’re thinking about working at: looking, listening, asking, and verifying. You should do all four.

Looking

Thinking about working for that popular, growing auto insurance company in town? Start looking at their products. Does their visual identity seem professionally executed? How usable is their app or website? Go ahead and actually sign up if you can. Was the process reasonably well designed? Nothing is ever perfect, but often times, just spending an hour or two with a company’s product will give you a feel for how much they care about details. And when I say “details”, I don’t just mean how buttery smooth is the animation but also how smooth is the “Forgot Password” process?

Take notes as you go, in case you end up interviewing there. It’s always good to have firsthand knowledge and constructive criticism ready for when someone asks you what changes you’d make to their product (do this tactfully though, as you don’t know what factors went into a given product decision).

Make sure to also look at competitors’ offerings. While the auto insurance site may not be as modern as your favorite social networking site, maybe it’s head and shoulders better designed than all other auto insurance sites. In an industry that perhaps moves slowly in terms of technology upgrades, maybe this company is moving 10x faster than its competitors. That would be a pretty good sign.

Listening

When recruiters or employees of the auto insurance company try to pitch their company to you, they will usually do so in a way that portrays their company in as positive of a light as possible. In other words, although it does happen, you’ll rarely hear a prospective employer tell you “design is an absolute mess here”, even though it very well might be. Instead, listen for coded language. Things like:

“Over the last year, design has become a real priority.” Why? What happened before that?

“Design has a seat at the table now.” Cool, why now? What problems occurred before that?

“We’re looking to bring some fresh design blood into the company.” What are you doing with all of this blood? What problems with the current staff are you trying to solve?

Every statement should be examined for possible hidden meaning. By the way, these people are just doing their jobs. When I recruit designers, I also try to accentuate the positive. It’s your job as a candidate though, to dig deeper. Especially since your prospective employer will be digging deeply into your work as well.

Asking

In addition to responding to statements like the coded ones above, there are some good universal questions you can ask on your own:

“What is the attrition rate of designers at your company?” This should ideally be low.

“Are designers paid on par with engineers and PMs? If not, how close are they?” Pay should ideally be close or equal. Don’t be surprised if you get some bad answers or non-answers here, depending on company.

“Who does the Head of Design report to?” The CEO is always the best answer, but a great COO, CTO, CPO, GM is fine too.

“When someone needs to break a rule here, what is the process?” If they need help, perhaps give an example of a rule you’ve needed to break in the past, and ask how they’d handle it.

“What is the one negative or challenging thing about working here that no one is telling me right now and I will only find out after I start?” It’s a bad sign if they don’t have an answer.

“When someone has an idea for something they want to build, what is the process of getting approval and then building it?” Ask for a lot of detail here, right down to prototyping, user testing, and release.

“How do decisions get made when Design, Engineering, and PM can’t agree on something?” You’ll have to judge for yourself whether you like the answer.

“Tell me about a time when a product design was made subjectively or in the face of opposing data.” You might need to ask a particular person to get a good answer here, but if the answer is “never”, that’s indicative of an overly rigid decision making process.

“How are designers judged and promoted here? Is it different than Engineering and PM?” Ideally there is a thoughtful, well-articulated process in place that rewards behaviors and not just outcomes. If you’re judged solely on the metrics you move, that’s a bad sign.

It’s up to you to ask these questions with tact and at the appropriate times, but you are well within your rights to ask them. In fact, it’s a bit reckless not to.

Verifying

Do you know anyone who has worked for this company, past or present? If so, ask to get coffee with them. Depending on how secret your candidacy is, you may need to keep your questions general, but there is a lot to be gleaned from employees who aren’t trying to pitch you on anything. Start by asking what their overall experience was like. Would they recommend the company to a friend as a good place to work? Dig, if you can, into some of the things the recruiter or hiring manager told you.

“I’ve heard the decision making process is pretty egalitarian. Design, PM, and Eng all take part in that process.”

To which you might hear:

“Yep. It’s a great system. I always felt like an equal partner.”

Or:

“Haha. I am dying of laughter right now. If you’re in the room at all, it will just be to tell you what decision has been made without you.”

Importantly, when you hear things like this, you need to get a feel for whether those conditions still exist. Did this employee work there three months ago or three years ago? Is the person who enacted that decision-making process still even there? Because of the passage of time, you may get both false positive and false negative results from ex-employees. It’s ok though… it’s just a data point for you.

Also, at massive, sprawling companies, you may get different answers depending on which department’s employees you talk to. Maybe the auto insurance company’s consumer product is built in San Francisco and its broker product is built in Seattle. Maybe the working environment in San Francisco sucks but it’s great in Seattle.

So… by looking, listening, asking, and verifying, you can get a pretty accurate idea of what sort of company you are thinking about joining.

Fixing the Product Development Process, One Company at a Time

One of the reasons I wrote this piece was that I read a Tweet from a well-followed person in San Francisco talking about how the best companies in the world are all design-driven now. I get what he was trying to say, and I think that directionally, more companies are design-driven now than ever, but the vast majority of boots-on-the-ground designers in the world know how much work is still left to do. They also know that just because some high-profile companies have figured out that design is important, that doesn’t mean their own company in Seattle, or Omaha, or Bangalore has. A rising tide lifts all boats, but this is more of a slow motion wave you need to stay upright long enough to ride.

Finally, I also think it’s important to highlight the value of helping upgrade your own company’s product development processes. Designers love talking about the actual product design work they’ve done in the form of visual artifacts and launched services. Just as valuable, however, is the work that went into reshaping the processes that made these products possible. PMs make their own PM-centric contributions to what product development processes look like, and engineers do the same with their own lens. By adding your own perspective as a designer and improving the product development process at your own company, you’re accomplishing something you may not even get to accomplish at a place like Apple… and that, is something to be proud of.

(This post also available on Medium.)

An Epitaph for Newsvine

Today, the creation I am most proud to have brought into the world disappeared from the internet.

After 11 years and 7 months in service, Newsvine, a participatory news site I launched with four friends on March 1st, 2006 was officially sunsetted by NBCNews.

Although I’ve been away from the company and the service for five years now, today brings back a rush of memories and some perspective on how the problems Newsvine set out to solve over a decade ago are actually the opposite of the problems that most need solving today.

In 2005, I found myself five years into a stint at Disney, wondering what was next for news. We owned ESPN, ABCNews, and several other media properties, but most of the fresh new takes on news seemed to be coming from non-traditional sources. Neither Twitter nor the iPhone had been invented yet, and Facebook was still just a campus dating site, but blogs were sprouting up by the thousands and sites like Digg and Slashdot were becoming popular destinations.

There seemed to be this growing bifurcation between mainstream media and citizen journalism. Mainstream newsrooms didn’t want to share their platform with amateur writers, and a lot of amateur writers grew more distrustful of mainstream media. Our big idea with Newsvine was to license the same Associated Press feed of professional reporting that made up the majority of what you’d see on a site like CNN.com, publish it faster than any other site in the world, and enlist citizens from around the world to create original, paid journalism around and alongside it… and open up every single piece of content for threaded discussion as well.

In other words:

CNN = AP Wire stories + Professional Journalism

Newsvine = AP Wire stories + Citizen Journalism + Discussion

… and we could do it all with a staff of under 10 people.

We didn’t know for sure if it was going to work, but the day we decided we’d be happy to have tried it even if it failed was the day we ended up quitting our jobs (incidentally, if you are thinking about leaving your job for a new risky thing, this is the acid test I recommend).

We spent about 6 months getting the company off the ground and the service into public beta, and it wasn’t long until extraordinary acts of journalism began appearing. Chris Thomas, one of our most prolific users, broke news of the Virginia Tech shootings on Newsvine before it appeared anywhere else. Jerry Firman, a 70 year old Newsviner from Ohio, got his name on the ballot for Congress and documented the process of running for office. Corey Spring, a student at Ohio State, scored an original interview with Dave Chappelle.

The design, tech, and operational work associated with growing Newsvine were fairly straightforward, but the one thing that seemed to get more and more difficult as the site grew was moderating and cultivating the community. Your first 1000 users are easy. People are just happy to be there. Then when you get to 10,000 you have a few fights here and there but nothing unmanageable. Even at 100,000, a small team of thoughtful people can stay on top of things. But when you hit 1 million, 10 million, and beyond, the community becomes much less intimate and more volatile.

Such was the case when we were acquired in 2007 by MSNBC.com (now NBCNews.com). Our site was already decently big but MSNBC’s was many times bigger… about 45 million people at the time. The post-acquisition work was twofold: 1) continue growing Newsvine as a standalone property, 2) use our technology to add registration, profiles, discussion threads, and other features to MSNBC.com. We also ended up powering all of the company’s blogs and some other things.

I ended up staying at MSNBC for about five years, and I would say the results of the experiment were mixed overall. On the upside, we provided technology that helped launch new editorial brands quickly and connect journalists to their audiences, but on the downside, “community” at that scale can be very messy. Additionally, with the eventual rise of Twitter and Facebook, Newsvine never grew to those usage levels. MSNBC.com was a great parent throughout though, and I have nothing but love for the people I worked with.

It’s interesting to compare Newsvine (and sites like it) to the now wildly successful fortunes of Facebook and Twitter. Newsvine at its core was a news site with a social network wrapped around it. Facebook at its core is a social network with news (and photos, and events, etc) wrapped around it. Twitter is probably structured more like Facebook in this regard as well, but its biggest challenge, in my opinion, has always been a lack of commitment to building those real-life social connections into the service.

When we look at how the average person’s news and media diet has changed over the last decade or so, we can trace it directly back to the way these and other modern organizations have begun feeding us our news. Up until 10 or 15 years ago, we essentially drank a protein shake full of news. A good amount of fruits and vegetables, some grains, some dairy, some tofu, and then a little bit of sugar, all blended together. Maybe it wasn’t the tastiest thing in the world but it kept us healthy and reasonably informed. Then, with cable news we created a fruit-only shake for half the population and a vegetable-only shake for the other half. Then with internet news, we deconstructed the shake entirely and let you pick your ingredients, often to your own detriment. And finally, with peer-reinforced, social news networks, we’ve given you the illusion of a balanced diet, but it’s often packed with sugar, carcinogens, and other harmful substances without you ever knowing. And it all tastes great!

As someone who has created Newsvine, worked at Twitter, and had many discussions with people at Facebook, I can tell you that this sort of effect was never “part of the business plan”. However, maximizing engagement was and still is, and that has led to a world in which what appears on people’s screens is what is most likely to keep one’s attention, as opposed to what is actually most important to know and understand.

The solutions to these problems will not come easy. They aren’t as simple as banning some jerk from Twitter or improving bot detection on Facebook. We’ve trained people to get their news and information from the cookie jar, and since we now know exactly what that world looks like, we must begin the job of untraining them… or at least engineering a healthy cookie.

We probably got a lot of things wrong at Newsvine, but one thing I still feel we got absolutely right is our longstanding tagline:

Get Smarter Here.

That’s really the only promise we ever wanted the service to fulfill.

After 800,000 articles, 65 million comments, 11+ years, thousands of new friendships, and at least one marriage and child from the site that I’m aware of, I’m confident it has fulfilled its mission for at least some who roamed its jungles.

(Special thanks to the entire Newsvine community. Without the dedicated efforts of all of you, we would have never had this special corner of the internet to write, meet new people, and have our perspectives changed. Thanks also to my partners Calvin, Mark, Lance, Josh, Tom, Tyler, Sally, Luke, Todd, Bobby, Dave, Arun, Jim, Mike, Brenda, Carl, Charlie, Rex, and everyone else at MSNBC.com for making this all possible. Also, extra special thanks to Nick, one of our investors, for introducing me to my wife, who I would have never met were it not for this little chance we took. And finally, thanks to my wife who helped get me through everything back then and since.)

(This post also available on Medium.)